We're not able to accomplish your ask for presently on account of a program mistake. Make sure you try all over again just after a couple of minutes.

With the passing of SECURE Act two.0, time has become to supply a retirement system. We will help you navigate the most recent variations and enhanced tax incentives to better your business and retain happy staff members.

You'll be able to shape your portfolio's expected risk/reward by altering the amount of cash you allocate to stocks and bonds.

And there might be environments where … bonds is going to be very important without a doubt. So, I do are convinced considering a balanced portfolio, thinking about your daily life phase along with your proximity to needing your assets to attract upon need to be essential guideposts as you consider positioning your portfolio these days."

Sector funds Whilst these invest in shares, sector funds, as their name implies, deal with a particular phase from the financial state. They are often beneficial equipment for traders looking for prospects in numerous phases on the economic cycle.

On the list of keys to effective investing is learning ways to stability your consolation amount with risk against your time horizon. Commit your retirement nest egg much too conservatively in a young age, therefore you operate a twofold risk: (1) that the growth rate of your respective investments is not going to keep tempo with inflation, and (two) your investments may well not increase to an amount you need to retire with.

Our insightful analysis, advisory and investing abilities give us exceptional and wide viewpoint on sustainability matters.

Observe a savings and investing route that may help you access your objectives for retirement—it doesn't matter what arrives your way in everyday life.

One method to balance risk and reward in the investment portfolio will be to diversify Risk management for retirement your assets. This system has numerous ways of mixing assets, but at its root is The easy notion of browse around these guys spreading your portfolio throughout a number of asset lessons.

"As Harry Markowitz 1st proven in his landmark investigate in 1952, a portfolio's risk level is not just the sum of its individual components but in addition is dependent upon correlation, or how the holdings interact with one another," points out Arnott.

We like to take a position in individual stocks, which supplies us the opportunity to outperform the market, but we also imagine Warren Buffett is true about investing passively in index funds.

Remaining a little enterprise operator or perhaps a solo entrepreneur indicates you’re all on your own In regards to conserving for retirement. But that doesn’t suggest it is possible to’t get at the least many of the advantages accessible to persons with employer-sponsored retirement plans.

But This is in which your risk tolerance results in being an element. In spite of your time and efforts horizon, you ought to only tackle a degree of risk with which you happen to be relaxed. So even if you're saving for a protracted-term target, for anyone who is extra risk-averse you may want to think about a far more well balanced portfolio with some mounted income investments.

Described reward plans tend to be dearer and complex for businesses to work, a lot of companies are opting to supply alternative retirement plans as a substitute, like 401(k)s.

Emilio Estevez Then & Now!

Emilio Estevez Then & Now! Susan Dey Then & Now!

Susan Dey Then & Now! Samantha Fox Then & Now!

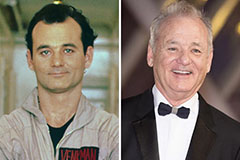

Samantha Fox Then & Now! Bill Murray Then & Now!

Bill Murray Then & Now! Jaclyn Smith Then & Now!

Jaclyn Smith Then & Now!